As a merchant, finding ways to maximize savings while offering customers affordable options is crucial in today's competitive market. One strategy that can significantly impact your bottom line is the implementation of dual pricing or compliant surcharging. By understanding how these practices work and ensuring compliance with state regulations, you can create an opportunity to provide customers with more choices and save money on transaction fees.

In this blog post, we will delve into the concept of dual pricing and compliant surcharging for merchants, discussing how it works and the steps you need to take to confirm if your state allows it. We will also explore the benefits for both merchants and customers, including the potential for massive savings and the importance of proper signage to inform customers of their options. By the end of this post, you will have a clear understanding of how to implement dual pricing and compliant surcharging to maximize your savings and provide a better experience for your customers.

How it Works: Understanding Dual Pricing and Compliant Surcharging for Merchants

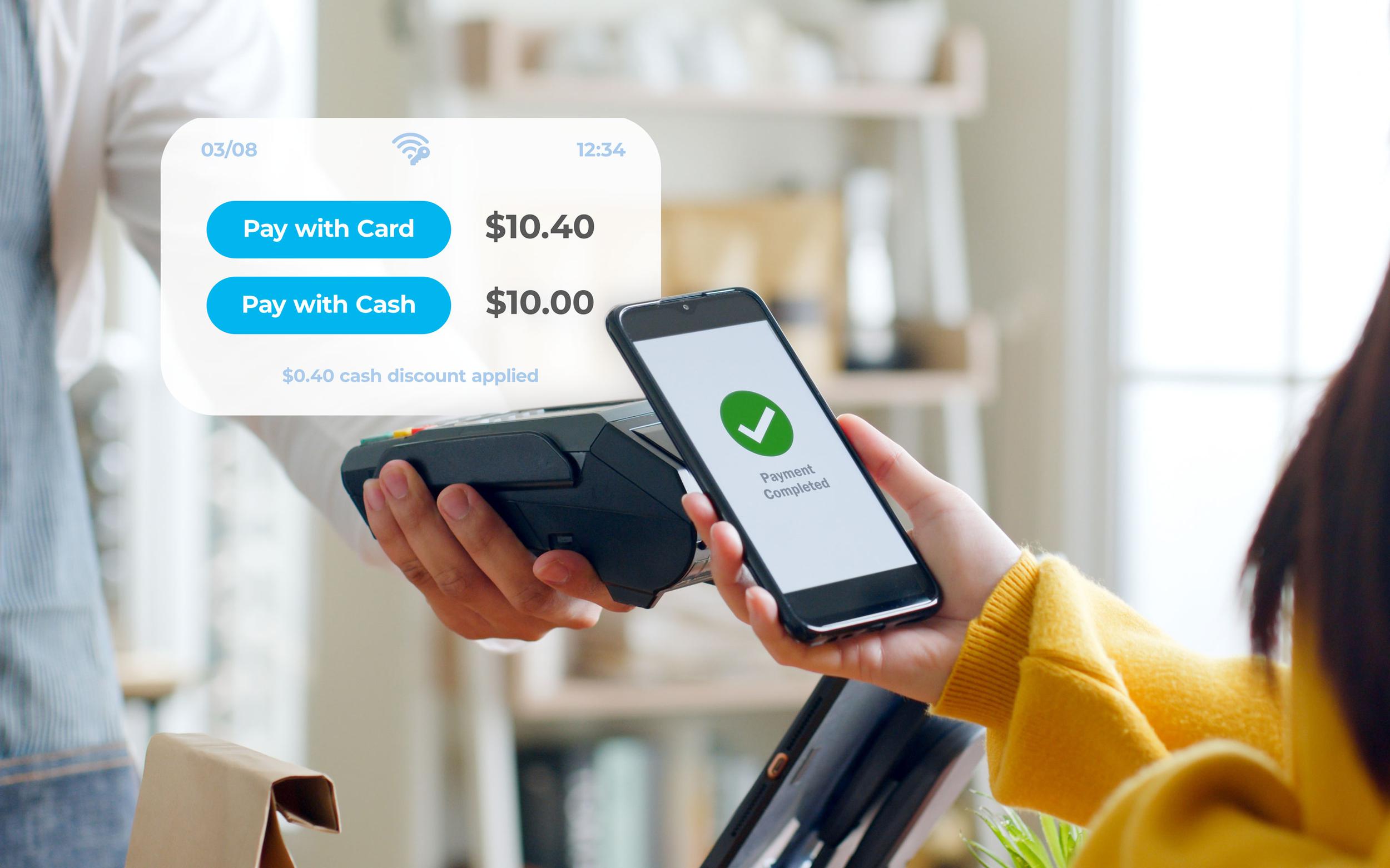

Dual pricing and compliant surcharging have become popular strategies for merchants to maximize profit while offering customer choice and potential savings. Dual pricing involves offering customers the option to pay with either cash or card at different price points, allowing merchants to pass on the savings from cash transactions to customers. Compliant surcharging, on the other hand, involves adding a small fee to credit card transactions to cover processing costs, while still providing customers the choice to pay with cash or debit card to avoid the surcharge. By understanding these strategies and implementing them effectively, merchants can ensure they are offering the best pricing options for their customers while boosting their bottom line.

When implementing dual pricing and compliant surcharging, merchants should establish clear policies and procedures to ensure compliance with state regulations and card network rules. This includes proper signage to inform customers of their options and any associated fees. Additionally, it's important to ensure that customers are given the choice to pay with their preferred payment method and are aware of the potential savings or fees associated with each option. By understanding how dual pricing and compliant surcharging work, merchants can navigate the complexities of payment pricing and offer the best possible experience for their customers while optimizing their revenue.

Confirm if Your State Allows: Know your States Rules & Regulations

Before implementing dual pricing and compliant surcharging, it is essential for merchants to confirm if their state allows this practice. Each state has its own regulations and laws regarding surcharging, so it is important to do thorough research and consult with your payment provider to ensure compliance. Once it has been confirmed that dual pricing and compliant surcharging is allowed in the state, merchants must ensure proper signage for customers to clearly communicate the additional charges. As of now, Connecticut and Massachussetts are the only states where it cannot be done.

Clear Signage is The Key: Ensuring Proper Signage for Customers

In order to maintain transparency and provide customers with the necessary information, proper signage must be displayed at the point of sale to notify customers of any surcharges or differences in pricing. This includes clearly informing customers of the specific fees associated with credit card payments and dual pricing, allowing them to make informed decisions about their payment method and potential savings. By confirming if their state allows dual pricing, and ensuring proper signage for customers, merchants can effectively implement this practice while staying compliant with regulations.

Customer Choice and Massive Savings: Implementing Dual Pricing for Maximum Benefit

By clearly displaying the different prices for each payment option, merchants can attract more customers and increase sales. This gives customers the freedom to choose how they want to pay, while also benefiting the merchant with cost savings associated with credit card fees. Merchants can use dual pricing to create a win-win situation for both themselves and their customers. By providing a clear choice and the potential for savings, dual pricing can lead to increased customer satisfaction and loyalty. Additionally, merchants can reap the benefits of reduced processing fees and increased sales, making it an effective strategy for optimizing revenue and providing value to customers.

Interested in learning more about Dual pricing or Surcharging?

At SlidePay, we specialize in helping businesses transition to dual pricing and compliant surcharging. We work diligently alongside our partners and clients to create specialized custom solutions for their business. We can easily get you set up in either dual pricing or surcharging to start saving you money. You can learn more about our payment solutions online, or contact us to schedule a consultation today.

Stay updated on latest offers and industry insights.